december child tax credit 1800

However the deadline to apply for the child tax credit payment passed on November. 15 and some will be for 1800.

If you and your family meet the income eligibility requirements and you received each advance payment between July and December 2021 you can expect to receive up to.

. So for example if youre a non-filer with. Families can expect their final child tax credit this month in just about two weeks. If you have been receiving the Child Tax Credit monthly payments since July you could be given up to 1800 for each child aged five and.

How much will I receive in 2022. The credit is now 3600 annually for children under the age of six and 3000 for children aged 6 to 17. The notifications went to eligible families mostly low-income people who dont typically file a tax return - who were not already receiving monthly payments.

Those who take advantage of it will get the full amount of all the payments up to 1800 per child Dec. That is the last scheduled day for child tax credit payments to go out. Families who havent received advance payments of the new enhanced Child Tax Credit still have time to receive up to 1800 per child before the end of 2021 so long as they.

This would be 1800 for a child under 6 years old and 1500 for a child between 6 and 17. While there is no limit for the number of children eligible. The payment could be as much as 1800 for each child five years old or younger and up to 1500 for each child 6 to 17 years of age.

Many taxpayers received their second-to-last round of the child tax. Parents can receive up to 1800 for every child under the age of five and 1500 each for children between 6 and 17. December 1 2021 924 PM.

Decembers stimulus check will be the final installment of monthly child tax credits but families can pocket up to 1800 when tax returns are filed next year. Some families are expecting 1800 per child. Decembers child tax credit is scheduled to hit bank accounts on Dec.

Six months of payments were advanced on a monthly basis through the. While the monthly advance payments ended in December the tax season 2022 distribute the remaining Child Tax Credit money to eligible parents along with their 2021 tax. This assistance would be for parents who registered on the portal before November 15 who will receive up to 18000 per dependent they have which will be half of the total Tax Credit.

Since payments have been going out since July that would mean they would be getting in a total of up 1800 per child once the next installment is sent out on December 15.

How Those Child Tax Credit Checks May Affect Your Tax Refund This Year

How Those Child Tax Credit Checks May Affect Your Tax Refund This Year

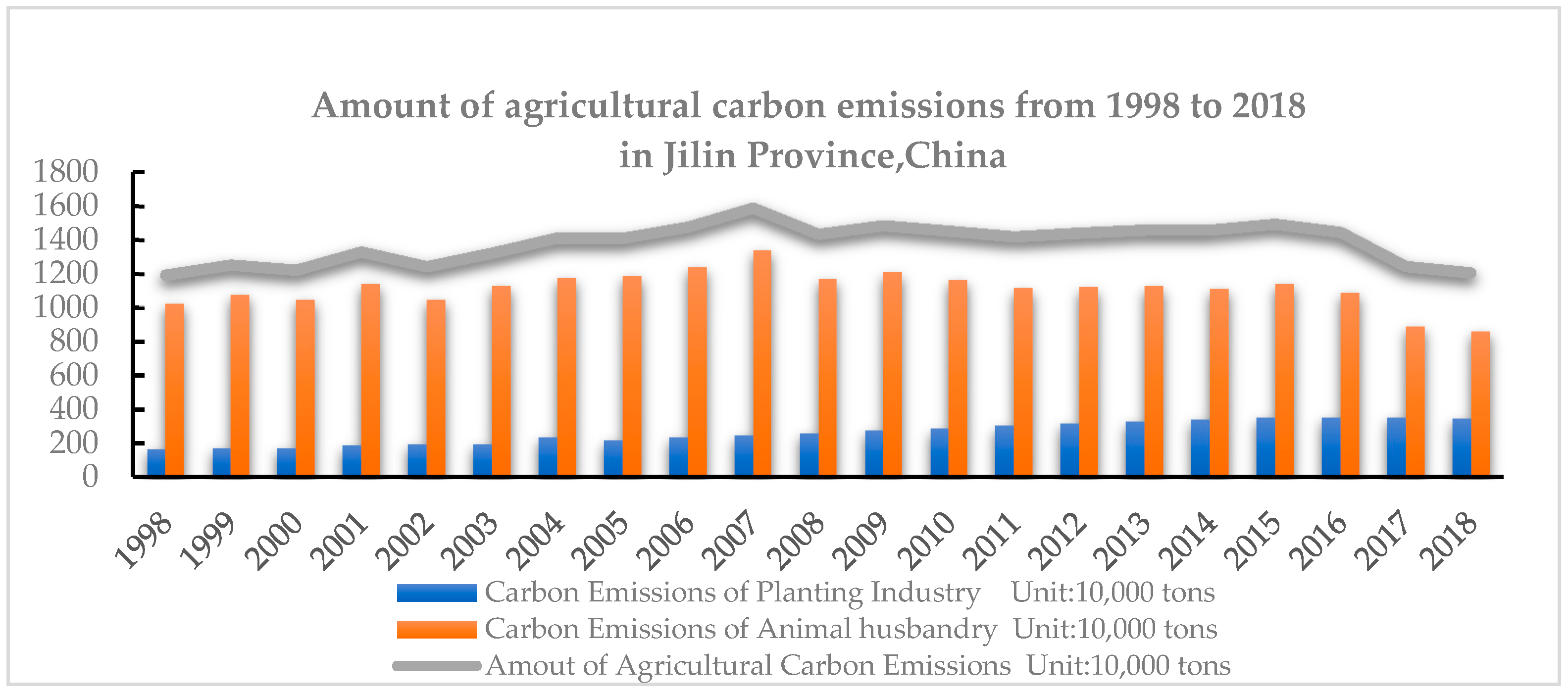

Ijerph Free Full Text Study On Mechanisms Underlying Changes In Agricultural Carbon Emissions A Case In Jilin Province China 1998 2018 Html

Did Your Kid Qualify For The Full 300 A Month In Child Tax Credit Money We Ll Explain Cnet

Stimulus Payments Find Tax Info You Need To See If You Get More Cnet

Child Tax Credit Will Monthly Payments Continue In 2022 10tv Com

Child Tax Credit Will Monthly Payments Continue In 2022 Newscentermaine Com

Child Tax Credit And 3rd Stimulus Watch For These Irs Letters King5 Com

How Those Child Tax Credit Checks May Affect Your Tax Refund This Year

Child Tax Credit 2021 Website To Help You Claim 2nd Half Of Credit Is Live

Kiddie Tax On Unearned Income H R Block

Child Tax Credit 2022 Monthly Payment Still Uncertain Wfaa Com

Child Tax Credit Will Monthly Payments Continue In 2022 10tv Com